Predictions for 2023 are in. From the rise of chatbots to tougher consumer privacy regulations and embedded finance, these predictions point to one thing—the need for banks and credit unions to be nimble in the face of certain change. Without the optimal level of operational and technological readiness, financial institutions will be less capable of making the right strategic moves. Banks and credit unions of all sizes need expert insights and guidance to evaluate opportunities and flawlessly execute their strategies. From understanding new technologies or business models, to choosing and implementing new technology, training staff and reallocating resources, banks and credit unions can benefit from a technology partner. This partner can offer these key services to help organizations tackle what may be on the horizon while executing on current initiatives:

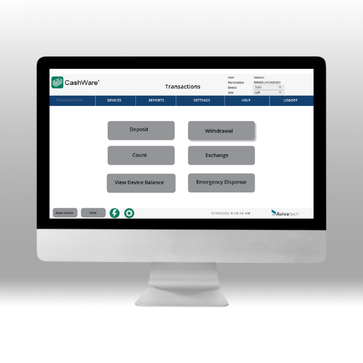

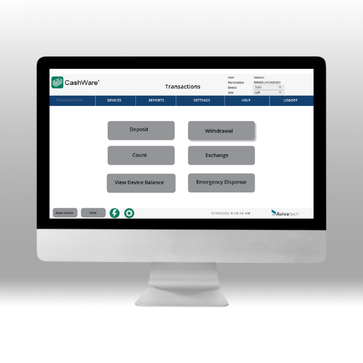

The Operational Advantages Banks and Credit Unions Get from a Strategic PartnerOperational Advantage 1: Professional ServicesA technology partner who serves leading banks and credit unions can help your organization keep pace with innovation and navigate complex challenges specific to your business operations and goals. For example, the capabilities a trusted partner can bring to a large-scale technology conversion or upgrade can be very valuable. Consider the challenge facing a bank that’s upgrading teller capture systems and converting to a new core system across multiple branches and regions. For a bank, this may be an event that happens once every five to 10 years. Chances are the team that led the last conversion or upgrade is no longer with the organization. However, an experienced branch transformation partner can easily overcome this knowledge gap. This partner may have done system mergers and conversions dozens of times per year. They have standardized deployment methods and seasoned personnel who have worked with virtually all the core banking systems and other fintech equipment and software on the market. They also have the resources and capabilities to manage exceptions and guarantee zero downtime. This is the partner you can count on to have your branches ready for business by the scheduled project completion time. Plus, when you use professional services to augment your staff, you can often boost the knowledge and skills of your team. Exposure to strategic services and processes may give them a new perspective on their role and what they can contribute to the organization. It can also free them to engage in innovative future-focused projects. Operational Advantage 2: Automation The CashWare cash automation solution from Avivatech streamlines cash management to boost teller productivity. The CashWare cash automation solution from Avivatech streamlines cash management to boost teller productivity. Labor shortages are making it crucial for banks to leverage their human capital more efficiently. That’s why many financial institutions are implementing branch automation technology, which eliminates manual processes, saving time and money. Banks and credit unions are increasingly striving to make the customer experience exceptional across all channels, from digital to the branch. When it comes to the branch experience, many organizations are strategically using automation solutions in areas that will have a direct impact on customer satisfaction and branch growth. A key area of focus is cash and check automation. Tellers can make a significant impact on customer experience and satisfaction. By reducing manual processes in branch transactions, staff can spend more time and attention on giving customers advice on their financial well-being. Easy to use cash automation systems eliminate the need for tellers and other personnel to count cash. For example, the CashWare cash automation simplifies the cash environment in banks and credit unions, streamlining teller functions so they can focus on their customer. Tellers now have time to engage with guests when the CashWare solution reduces transaction time and keeps teller functions easy to navigate. Many banks already have cash automation solutions. However, forward-thinking financial institutions are investing in solutions that aggregate data from cash recyclers and teller systems across the entire branch network. These advanced solutions provide the reporting and analytics capabilities that make the branch executives’ jobs easier. As a result, they have more time to focus on more pressing operational challenges. Similar solutions are available for vault and lockbox operations. Your financial technology partner can advise you on the right solution and configuration across your organization. Operational Advantage 3: Technology That Supports UptimeWhether you’re exploring new branch models or looking into the emerging banking as a service opportunity, your financial institution must keep everyday operations going. That requirement makes it a necessity to have easy access to hardware for both branch operations and for commercial customers. Malfunctioning equipment can impact the retail customer experience. It can also severely impact your commercial customers whose broken scanner or cash recycler may make it difficult to access their working capital. The logistics of acquiring and shipping scanners, printers and other equipment can be complicated, expensive, and labor intensive. Most banks will maintain an inventory of spares; however, managing that hardware can be a hassle. A leading, end-to-end branch solution provider offers technology services to assist you with these essential procurement needs. If your bank or credit union offers a comprehensive RDC program, you can leverage their inventory management and just-in-time delivery services for easy access to new or replacement equipment. A full-service partner will ship scanners and printers from their inventory directly to your commercial customers. Additionally, they will provide similar services for your branches, to ensure that your teller line and other personnel have the printers and scanners they need. In addition, their end-to-end solution reduces the workload of your treasury and IT departments. As a result, these departments are no longer saddled with the complex logistics, data storage, and analytics a successful RDC program requires. That means your valuable internal resources can focus on more strategic projects. Get the Resources You Need for 2023No matter what trends will shape your strategy this year, you might need professional services and other technology solutions to maintain or exceed your operational standards. Plus, if you decide to launch new business models or solution, you might need to leverage the guidance and expertise of a strategic advisor who has been at the forefront of banking innovation for decades.

You can find the partner you need in Benchmark Technology Group. Contact us to find out how we can drive growth and productivity at your financial institution in 2023 and beyond.  Predictions for 2023 are in. From the rise of chatbots to tougher consumer privacy regulations and embedded finance, these predictions point to one thing—the need for banks and credit unions to be nimble in the face of certain change. Without the optimal level of operational and technological readiness, financial institutions will be less capable of making the right strategic moves. Banks and credit unions of all sizes need expert insights and guidance to evaluate opportunities and flawlessly execute their strategies. From understanding new technologies or business models, to choosing and implementing new technology, training staff and reallocating resources, banks and credit unions can benefit from a technology partner. This partner can offer these key services to help organizations tackle what may be on the horizon while executing on current initiatives:

The Operational Advantages Banks and Credit Unions Get from a Strategic PartnerOperational Advantage 1: Professional ServicesA technology partner who serves leading banks and credit unions can help your organization keep pace with innovation and navigate complex challenges specific to your business operations and goals. For example, the capabilities a trusted partner can bring to a large-scale technology conversion or upgrade can be very valuable. Consider the challenge facing a bank that’s upgrading teller capture systems and converting to a new core system across multiple branches and regions. For a bank, this may be an event that happens once every five to 10 years. Chances are the team that led the last conversion or upgrade is no longer with the organization. However, an experienced branch transformation partner can easily overcome this knowledge gap. This partner may have done system mergers and conversions dozens of times per year. They have standardized deployment methods and seasoned personnel who have worked with virtually all the core banking systems and other fintech equipment and software on the market. They also have the resources and capabilities to manage exceptions and guarantee zero downtime. This is the partner you can count on to have your branches ready for business by the scheduled project completion time. Plus, when you use professional services to augment your staff, you can often boost the knowledge and skills of your team. Exposure to strategic services and processes may give them a new perspective on their role and what they can contribute to the organization. It can also free them to engage in innovative future-focused projects. Operational Advantage 2: Automation The CashWare cash automation solution from Avivatech streamlines cash management to boost teller productivity. The CashWare cash automation solution from Avivatech streamlines cash management to boost teller productivity. Labor shortages are making it crucial for banks to leverage their human capital more efficiently. That’s why many financial institutions are implementing branch automation technology, which eliminates manual processes, saving time and money. Banks and credit unions are increasingly striving to make the customer experience exceptional across all channels, from digital to the branch. When it comes to the branch experience, many organizations are strategically using automation solutions in areas that will have a direct impact on customer satisfaction and branch growth. A key area of focus is cash and check automation. Tellers can make a significant impact on customer experience and satisfaction. By reducing manual processes in branch transactions, staff can spend more time and attention on giving customers advice on their financial well-being. Easy to use cash automation systems eliminate the need for tellers and other personnel to count cash. For example, the CashWare cash automation simplifies the cash environment in banks and credit unions, streamlining teller functions so they can focus on their customer. Tellers now have time to engage with guests when the CashWare solution reduces transaction time and keeps teller functions easy to navigate. Many banks already have cash automation solutions. However, forward-thinking financial institutions are investing in solutions that aggregate data from cash recyclers and teller systems across the entire branch network. These advanced solutions provide the reporting and analytics capabilities that make the branch executives’ jobs easier. As a result, they have more time to focus on more pressing operational challenges. Similar solutions are available for vault and lockbox operations. Your financial technology partner can advise you on the right solution and configuration across your organization. Operational Advantage 3: Technology That Supports UptimeWhether you’re exploring new branch models or looking into the emerging banking as a service opportunity, your financial institution must keep everyday operations going. That requirement makes it a necessity to have easy access to hardware for both branch operations and for commercial customers. Malfunctioning equipment can impact the retail customer experience. It can also severely impact your commercial customers whose broken scanner or cash recycler may make it difficult to access their working capital. The logistics of acquiring and shipping scanners, printers and other equipment can be complicated, expensive, and labor intensive. Most banks will maintain an inventory of spares; however, managing that hardware can be a hassle. A leading, end-to-end branch solution provider offers technology services to assist you with these essential procurement needs. If your bank or credit union offers a comprehensive RDC program, you can leverage their inventory management and just-in-time delivery services for easy access to new or replacement equipment. A full-service partner will ship scanners and printers from their inventory directly to your commercial customers. Additionally, they will provide similar services for your branches, to ensure that your teller line and other personnel have the printers and scanners they need. In addition, their end-to-end solution reduces the workload of your treasury and IT departments. As a result, these departments are no longer saddled with the complex logistics, data storage, and analytics a successful RDC program requires. That means your valuable internal resources can focus on more strategic projects. Get the Resources You Need for 2023No matter what trends will shape your strategy this year, you might need professional services and other technology solutions to maintain or exceed your operational standards. Plus, if you decide to launch new business models or solution, you might need to leverage the guidance and expertise of a strategic advisor who has been at the forefront of banking innovation for decades.

You can find the partner you need in Benchmark Technology Group. Contact us to find out how we can drive growth and productivity at your financial institution in 2023 and beyond. Comments are closed.

|

|

RSS Feed

RSS Feed